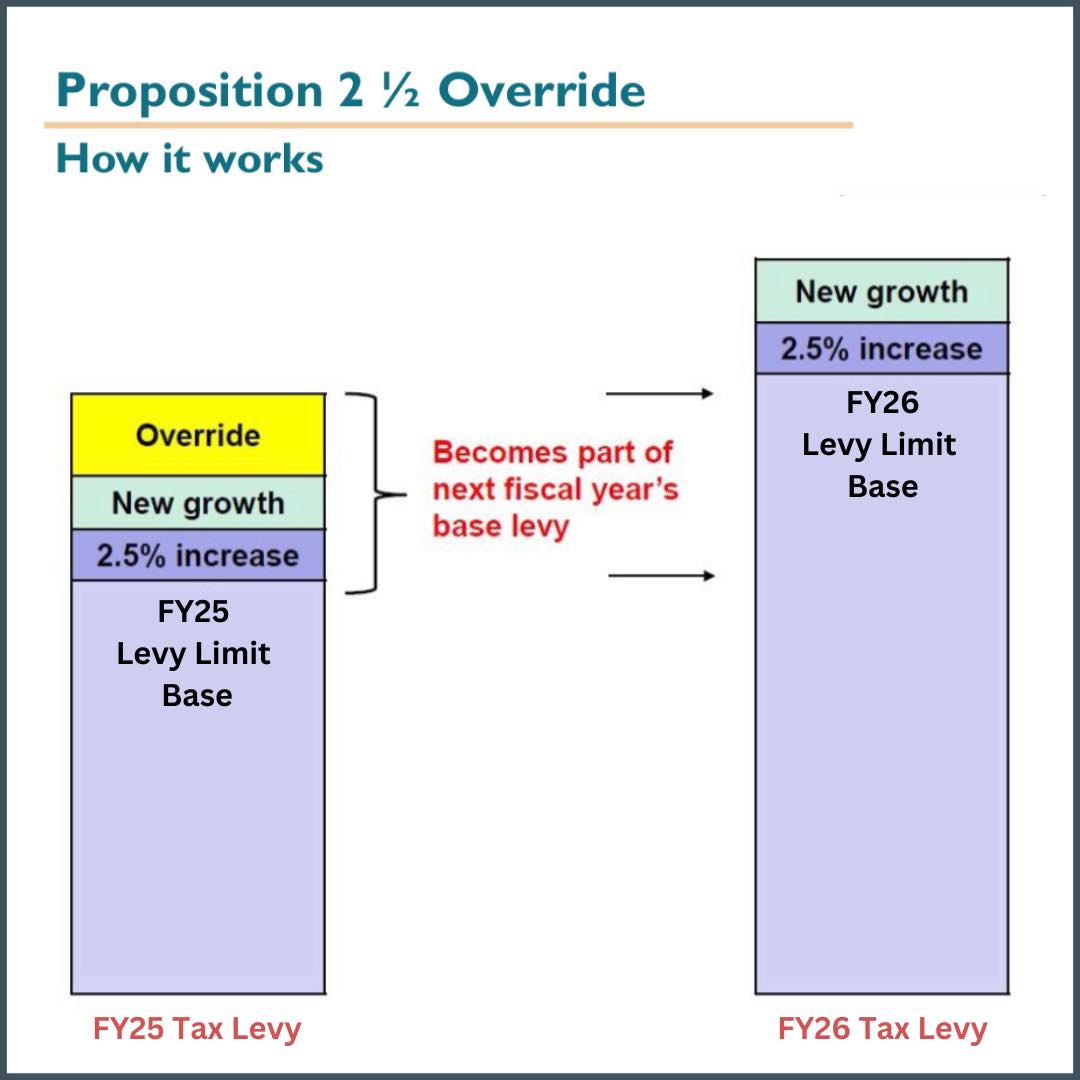

Proposition 2 1/2 Override - How it Works

Under Proposition 2 1/2, a community's tax levy limit increases by 2 factors annually: 1) an increase of 2.5% of the prior year's tax levy limit, and 2) a dollar amount derived from the value of new construction and other growth in the local tax base since the previous year called New Growth.

A community cannot exceed its levy limit without voter approval. If Town Meeting votes to spend more than the Town can expect to collect in revenues, Proposition 2 1/2 provides local options for increasing the Levy Limit by passing, by majority vote in an election, an override. The Levy Limit can be increased only by popular vote in a referendum, not by Town Meeting. In short, Town Meeting approves the budget, an override is decided in an election.

By passing an override a community can assess a specific amount of property taxes in addition to its Levy Limit. An override results in a permanent increase in the Levy Limit. It is intended for funding ongoing programs and expenses. The graphic below attempts to illustrate how an override works, from an override year to the next.